lipetskart.ru

Prices

How To Purchase A New Home With Bad Credit

Can I Buy A Home With A Low Credit Score? · If you have bad credit and you're nervous that you won't be able to be approved when applying for a mortgage, don't. Here are a few of the most common bad credit loan examples for homeowners While payments are being made under a fixed agreement, though, no action will be. The truth is that there's no easy way to buy a home with no money down and bad credit, but you can often buy a home if you have just one of the two. “Bad credit means no mortgage.” Many people believe that if you have bad credit, you won't be able to get a mortgage. In reality, while having bad credit can. A bad credit score doesn't have to prevent you from owning a home. Learn how to get a home loan with poor credit by following the tips in this quick guide. In addition to the loan application methods mentioned above, there are also specific lenders and mortgage loan programs that cater to low and even no credit. Loan officer here. Low interest don't really exist today. Expect to get a rate between with no discount points. You can buy down your. Get Home Loans for Bad Credit at Most Attractive Interest Rates · 1. Low Credit Score: · 2. Down Payment Source: · 3. Closing Costs: · 4. FHA Approved Lender: · 5. The program allows for low down payments and has no minimum credit score requirement. However, if you have poor credit, expect to make a higher down payment. To. Can I Buy A Home With A Low Credit Score? · If you have bad credit and you're nervous that you won't be able to be approved when applying for a mortgage, don't. Here are a few of the most common bad credit loan examples for homeowners While payments are being made under a fixed agreement, though, no action will be. The truth is that there's no easy way to buy a home with no money down and bad credit, but you can often buy a home if you have just one of the two. “Bad credit means no mortgage.” Many people believe that if you have bad credit, you won't be able to get a mortgage. In reality, while having bad credit can. A bad credit score doesn't have to prevent you from owning a home. Learn how to get a home loan with poor credit by following the tips in this quick guide. In addition to the loan application methods mentioned above, there are also specific lenders and mortgage loan programs that cater to low and even no credit. Loan officer here. Low interest don't really exist today. Expect to get a rate between with no discount points. You can buy down your. Get Home Loans for Bad Credit at Most Attractive Interest Rates · 1. Low Credit Score: · 2. Down Payment Source: · 3. Closing Costs: · 4. FHA Approved Lender: · 5. The program allows for low down payments and has no minimum credit score requirement. However, if you have poor credit, expect to make a higher down payment. To.

Though it's difficult to get a mortgage with bad credit, it's not impossible. In fact, some mortgage types specifically cater to borrowers with less-than-ideal. What Do Mortgage Lenders Consider a Bad Credit Score? · Low Credit Scores. Minimum credit score as low as · Bankruptcy. No waiting period after a Chapter 7. Tips for getting a mortgage with bad credit · Shop around: No matter your credit score or financial situation, it pays to shop around. · Consider other lenders. The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. How can I buy a house with bad credit and low income? Three possibilities. 1. Pay cash. No. The truth is that there's no easy way to buy a home with no money down and bad credit, but you can often buy a home if you have just one of the two. THDA Loan THDA loans help low-income Tennesseans obtain affordable home loans with low interest rates and down payments. USDA Loan USDA loans offer no down. Buying a house with bad credit or low credit score can be challenging, but it's not impossible. Buying a house requires having money for a down payment, a solid. Buying a House with Bad Credit · Take Steps to Improve your Credit. Regardless of your credit history, it is important to reduce debtand improve your credit. Put your fears about buying a home with bad credit behind you. Just because you have bad credit or low credit scores or filed bankruptcy or gone through a. How To Qualify For an FHA Loan Despite Low Credit: Tips and Tricks. You can still buy a home even with bad credit. Even with a credit score of , you can. Many lenders will approve mortgages for qualified borrowers with bad credit. A few lenders even specialize in mortgages for homebuyers with a low credit score. Get an FHA Loan to Buy or Refinance a Home. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are. If your credit score is very low and no lenders seem interested, you will likely need to spend the next 12 months boosting your creditworthiness. Your Texas. It's not bad credit. It's simply no credit. Being short on credit is best interpreted with a human touch because it's possible to get a loan with no FICO score. Are you trying to Buy a House in Florida but worried about your Bad Credit? Don't worry - it's still possible to own a home even with a low credit score. How to buy a home with no credit · Pay in cash: Although it's rare, you can forgo a mortgage or credit history if you have the financial means to pay for a home. For more information on Buying A Home With Bad Credit programs from Riverbank Finance LLC, call us at or apply online today! Home Loans with low. What are your options? · Consider a low credit score home loan. One option to consider is a FHA loan. · Put more money down. If you have bad credit but also the. What are your options? · Consider a low credit score home loan. One option to consider is a FHA loan. · Put more money down. If you have bad credit but also the.

Bulimia Tips

The quest to be thin is common in this day and age. For some individuals, including those living with an eating disorder, it can turn into an obsession. The best way to communicate with someone who has an eating disorder is to use language that is supportive and be a good listener. It is important to show. Learn how eating disorder treatment teaches health eating habits and how learning how to eat healthy is an important step in recovery. People with the eating disorder bulimia often eat large amounts of food over short periods of time (binge eat). Then, they try to prevent weight gain by. Learn about the causes, signs, and treatment options for bulimia, a treatable eating disorder that involves binge eating and purging. Common eating disorders include anorexia nervosa, bulimia nervosa, binge-eating disorder, and avoidant restrictive food intake disorder. Each of these. Learn how eating disorder treatment teaches health eating habits and how learning how to eat healthy is an important step in recovery. Recovery from an eating disorder such as anorexia or bulimia is a long process. Here are some tips for family and friends to help support their loved one on. Any tips? Upvote 2. Downvote Reply reply. Share Extreme bulimia is going to kill me, and I need advice on what I can do to stay alive and. The quest to be thin is common in this day and age. For some individuals, including those living with an eating disorder, it can turn into an obsession. The best way to communicate with someone who has an eating disorder is to use language that is supportive and be a good listener. It is important to show. Learn how eating disorder treatment teaches health eating habits and how learning how to eat healthy is an important step in recovery. People with the eating disorder bulimia often eat large amounts of food over short periods of time (binge eat). Then, they try to prevent weight gain by. Learn about the causes, signs, and treatment options for bulimia, a treatable eating disorder that involves binge eating and purging. Common eating disorders include anorexia nervosa, bulimia nervosa, binge-eating disorder, and avoidant restrictive food intake disorder. Each of these. Learn how eating disorder treatment teaches health eating habits and how learning how to eat healthy is an important step in recovery. Recovery from an eating disorder such as anorexia or bulimia is a long process. Here are some tips for family and friends to help support their loved one on. Any tips? Upvote 2. Downvote Reply reply. Share Extreme bulimia is going to kill me, and I need advice on what I can do to stay alive and.

Do you have a friend with an eating disorder? Find out how you can best support them, including tips on what to do and what to say. Parents are the first line of defense against eating disorders. Get a list dos & don'ts, prevention tips and things to share with your kids from the leader. "Binge Breakers - Bulimia Recovery" Top 5 Bulimia Recovery Tips (Podcast Episode ) - Top questions and answers about "Binge Breakers - Bulimia Recovery". Look for a good time to begin a private conversation with the friend or loved one who may have an eating disorder. Review what to say and not say to those. Eating Disorders Information For Teens: Health Tips About Anorexia, Bulimia, Binge Eating, And Other Eating Disorders: Lawton, Sandra Augustyn. Those who suffer from bulimia often face difficulties controlling food intake, followed by episodes of binge eating and purging. It is vital to provide support. Common eating disorders include anorexia nervosa, bulimia nervosa, binge-eating disorder, and avoidant restrictive food intake disorder. Each of these. It's hard when someone you care about has an eating problem. Read our tips on how you can support them - and yourself. Bulimia Tips For Successful Recovery. If you're looking for pro bulimia tips - you're in the wrong place. Bulimia tips such as how to purge more easily merely. Find 11 tips for beating the binge eating cycle in this guide from lipetskart.ru Learn how to get back to a healthier relationship with food here. Binge eating disorder is a mental illness that manifests as a behavioral disorder. It causes chronic, compulsive overeating. Parents are the first line of defense against eating disorders. Get a list dos & don'ts, prevention tips and things to share with your kids from the leader. An eating disorder, mostly appears when your food habits reach levels of extremity. Anorexia nervosa and Bulimia are two main and the most common eating. Find out what you can do to help if your child has been diagnosed with an eating disorder. Do you have a friend with an eating disorder? Find out how you can best support them, including tips on what to do and what to say. Bulimia is an eating disorder where you binge and purge to try to control your weight. Find out the symptoms of bulimia and what help is available. Grocery shopping can be overwhelming, especially for those with eating disorders. Discover tips to make the experience more manageable in recovery. Find out what you can do to help if your child has been diagnosed with an eating disorder. If I could only give you 7 tips of bulimia recovery here is what I'd say: Meet your basic needs. - Sleep enough, eat enough.

Good Way To Make Fast Money

Some people earn good money by signing up as a delivery driver through apps like Uber Eats, Amazon Flex, or DoorDash. These apps allow you to set up your own. Jobs like building flatpack furniture, house cleaning, helping people move, designing a website, or mowing lawns are all great examples of what you can do in. The best ways i m going to tell you is, an app named “FIVERR” is used to earn money, which is very simple, useful and beneficial for you, as you. We don't just provide easy click jobs but offer interesting and fun tasks as well. Join us in shaping the future by participating in AI training, surveys. Money feeling tight? Check out these 25+ ways to make money fast. From online gigs to film crews, these tips and tricks will help you stack some extra cash. Make Money Fast is a title of an electronically forwarded chain letter created in which became so infamous that the term is often used to describe all. One of the easiest ways to make quick money in one day is to use survey sites that pay you cash. And I know this idea works since I've been using these types of. Another popular method to make quick money is selling or renting out one's possessions. You'd indeed be surprised to know the variety of things you can trade in. 7 Smart Ways to Raise Cash Fast · 1. Liquidate Your Assets · 2. Take on Odd Jobs · 3. Track Down Loose Change · 4. Organize a Garage Sale · 5. Tap Your Retirement. Some people earn good money by signing up as a delivery driver through apps like Uber Eats, Amazon Flex, or DoorDash. These apps allow you to set up your own. Jobs like building flatpack furniture, house cleaning, helping people move, designing a website, or mowing lawns are all great examples of what you can do in. The best ways i m going to tell you is, an app named “FIVERR” is used to earn money, which is very simple, useful and beneficial for you, as you. We don't just provide easy click jobs but offer interesting and fun tasks as well. Join us in shaping the future by participating in AI training, surveys. Money feeling tight? Check out these 25+ ways to make money fast. From online gigs to film crews, these tips and tricks will help you stack some extra cash. Make Money Fast is a title of an electronically forwarded chain letter created in which became so infamous that the term is often used to describe all. One of the easiest ways to make quick money in one day is to use survey sites that pay you cash. And I know this idea works since I've been using these types of. Another popular method to make quick money is selling or renting out one's possessions. You'd indeed be surprised to know the variety of things you can trade in. 7 Smart Ways to Raise Cash Fast · 1. Liquidate Your Assets · 2. Take on Odd Jobs · 3. Track Down Loose Change · 4. Organize a Garage Sale · 5. Tap Your Retirement.

(Spoiler: the best way to make money on YouTube is all the ways.) YouTube is make it easy for your fans to show their appreciation with their credit card. If you have an eye for photography and a great camera, you could earn plenty of money by selling your photographs to art galleries, personal clients, or even. Engaging in surveys isn't just about quick cash but a strategic move on how to make money on the side. Whether you're exploring how to get money. How to make money fast · Find out if you have unclaimed property · Sell unused gift cards · Trade in old electronics · Take surveys · Sell clothes and accessories. 1. Online and In-Person Research Studies: Up to $ an Hour 2. Online Surveys: $1 a Day 3. Find a Virtual Job 4. Make Extra Money Playing Online Games. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! No giftcards or discounts, you are paid cash! HOW. Digital marketing is a great choice if you're looking for smaller gigs to add to your income or experience. Or, you can turn it into your main work by taking on. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments. Make money & earn cash with Mode Earn App. Your #1 Earn App with over $,, earned & saved by users! Make money & earn cash for playing games! Another told me she wanted to know what type of freelance writing to focus on “to quickly earn well.” Turns out she'd spent a year procrastinating on getting. Here's how to make money fast. · Find random Craigslist jobs for quick ways to make money. · Rent out a room in your home. · Answer surveys online. · Walk dogs and/. If you're looking for quick money, yard sales have been extremely popular since your grandparent's day (Yard Sales, Garage Sales, Estate Sales are all pretty. When you need to make fast cash, selling some old things on a website like Craigslist can be a great way to make money without shipping things across the. If you don't mind getting your hands dirty, then starting a house cleaning business is a great way to make extra cash. The best way to find clients is through. Find a good stuff to promote on fiverr and promote it on forums, social media, email marketing and other areas. Soon you will have an avalanche of orders coming. Sell stuff from around your home. Probably one of the best ways to make money fast is to find items around your home to sell. The average person has a lot of. Survey Pop is the fastest, easiest way for making money from your phone. 82% of new members earn $5 sent to their PayPal within the first day of downloading. If creating content to sell someone else's product isn't really your jam, that's cool. You can still earn lucrative money online by exploring other avenues. 5. Selling Mining Materials. One of the best ways that you could grab some quick money in the game is by selling items and specifically the mining material. Make money doing what you do best using Instagram tools such as Branded Content, Badges in Live and Shopping. Discover ways to be creative and get paid.

Coinbase Lightning

With Lightning transactions on Coinbase incurring a % processing fee for sends only, users can expect faster processing times, with transactions settled. Coinbase users can perform instant Bitcoin transactions directly from their Coinbase accounts via the Lightning Network, including sending, receiving, and. Lightning Bitcoin's price has also fallen by % in the past week. The current price is $ per LBTC with a hour trading volume of $K. Currently. With Lightning transactions on Coinbase incurring a % processing fee for sends only, users can expect faster processing times, with transactions settled. Lightning is live on Coinbase! Lightspark is proud to bring the #Bitcoin Lightning Network to Coinbase, an exciting step toward modern. I heard lightning is available to use for transactions on Coinbase. I wanted to try to send some bitcoin from Coinbase exchange to my exodus wallet, but it. Coinbase to integrate Bitcoin Lightning Network in bid to drive adoption After more than a month of public deliberations, Coinbase has finally decided to. We're thrilled to announce that @Coinbase is rolling out support for the #Bitcoin Lightning Network powered by Lightspark Coinbase customers. Starting today, support for the Lightning Network via @lightspark will begin rolling out. Enjoy instant, low-cost BTC transfers. With Lightning transactions on Coinbase incurring a % processing fee for sends only, users can expect faster processing times, with transactions settled. Coinbase users can perform instant Bitcoin transactions directly from their Coinbase accounts via the Lightning Network, including sending, receiving, and. Lightning Bitcoin's price has also fallen by % in the past week. The current price is $ per LBTC with a hour trading volume of $K. Currently. With Lightning transactions on Coinbase incurring a % processing fee for sends only, users can expect faster processing times, with transactions settled. Lightning is live on Coinbase! Lightspark is proud to bring the #Bitcoin Lightning Network to Coinbase, an exciting step toward modern. I heard lightning is available to use for transactions on Coinbase. I wanted to try to send some bitcoin from Coinbase exchange to my exodus wallet, but it. Coinbase to integrate Bitcoin Lightning Network in bid to drive adoption After more than a month of public deliberations, Coinbase has finally decided to. We're thrilled to announce that @Coinbase is rolling out support for the #Bitcoin Lightning Network powered by Lightspark Coinbase customers. Starting today, support for the Lightning Network via @lightspark will begin rolling out. Enjoy instant, low-cost BTC transfers.

To send bitcoin on the Lightning Network your Kraken account must be verified to an Intermediate or Pro level account. You will also need a Lightning wallet. Bitcoin's layer 2 scaling solution Lightning may soon feature on the cryptocurrency exchange Coinbase in some capacity, according to its. As per the whitepaper, the Lightning ecosystem is comprised of two main products: Lightning protocol and Lightning incubator. Coinbase programs (excluding. On April 8th, Coinbase CEO Brian Armstrong posted on social media that the Bitcoin Lightning Network is “great” and that the layer 2 scaling. I ran into an issue with sending BTC off Coinbase exchange via the Lightning network to my Strike account. My transaction has been stuck for almost a week. Coinbase, one of the leading cryptocurrency exchanges, has finally integrated the Lightning Network (LN), a layer 2 scaling solution for Bitcoin. Coinbase. Starting today, support for the Lightning Network via @lightspark will begin rolling out. Enjoy instant, low-cost BTC transfers. Coinbase, one of the largest U.S.-based cryptocurrency exchanges, is looking to add support for Lightning Network on its trading platform. Get the latest price, news, live charts, and market trends about Lightning Bitcoin. The current price of Lightning Bitcoin in United States is $ per. In essence, Lightning allows two parties to open a payment channel between them, bypassing the need to record every single transaction on the Bitcoin blockchain. Coinbase rolled out support for Bitcoin's Lightning Network today, educing the cost of sending BTC more than 20 times less the average 2% credit card. Coinbase users can perform instant Bitcoin transactions directly from their Coinbase accounts via the Lightning Network, including sending, receiving, and. Coinbase, one of the leading cryptocurrency exchanges, has finally integrated the Lightning Network (LN), a layer 2 scaling solution for Bitcoin. Coinbase. The Lightning Network allows users to send or receive Bitcoin quickly and cheaply by moving transactions off of the main blockchain — you can think of it as. Experience faster, cheaper Bitcoin transactions by facilitating off-chain, peer-to-peer transfers with the Lightning network. Lightning is live on Coinbase! Lightspark is proud to bring the #Bitcoin Lightning Network to Coinbase, an exciting step toward modern. Coinbase, a U.S.-based cryptocurrency exchange, has announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase rolled out support for Bitcoin's Lightning Network today, educing the cost of sending BTC more than 20 times less the average 2% credit card. Get the latest price, news, live charts, and market trends about Lightning Bitcoin. The current price of Lightning Bitcoin in United States is $ per. Lightning Bitcoin's price has also risen by % in the past week. The current price is $ per LBTC with a hour trading volume of $K. Currently.

Setting Up A Landscaping Business

This blog will discuss what a landscaping business is, why you want to create one for yourself or your small business, and how to plan for success as an. Take care of the legal side of starting a business · Secure your business licenses. Before you start working, make sure you secure all the business licenses. These 7 steps outline the basic process for creating your landscaping company so you can start making a profit fast. In this post I want to talk about the story of how to start a landscaping business with no money. Everything you need to know to get your business up and. Take care of the legal side of starting a business · Secure your business licenses. Before you start working, make sure you secure all the business licenses. A lawn care business can be as simple as mowing lawns or as complex as ripping up a lawn to install a sustainable landscape that uses only native plants and is. How to Launch a Landscaping Business: These days, many people are trying to crawl into the entrepreneurship world. After all, everyone likes. A landscaping business plan outlines your business goals, operational plans, employee staffing plans, financial projections, and marketing strategies. How to Start a Landscaping Company · Create a business plan · Choose a business structure · Name your landscaping company · Register your business and open. This blog will discuss what a landscaping business is, why you want to create one for yourself or your small business, and how to plan for success as an. Take care of the legal side of starting a business · Secure your business licenses. Before you start working, make sure you secure all the business licenses. These 7 steps outline the basic process for creating your landscaping company so you can start making a profit fast. In this post I want to talk about the story of how to start a landscaping business with no money. Everything you need to know to get your business up and. Take care of the legal side of starting a business · Secure your business licenses. Before you start working, make sure you secure all the business licenses. A lawn care business can be as simple as mowing lawns or as complex as ripping up a lawn to install a sustainable landscape that uses only native plants and is. How to Launch a Landscaping Business: These days, many people are trying to crawl into the entrepreneurship world. After all, everyone likes. A landscaping business plan outlines your business goals, operational plans, employee staffing plans, financial projections, and marketing strategies. How to Start a Landscaping Company · Create a business plan · Choose a business structure · Name your landscaping company · Register your business and open.

Looking to start a landscaping business but don't know how? Here are 13 steps to help get your business up and running. Start Your Own Lawn Care or Landscaping Business: Your Step-by-Step Guide to Success (StartUp Series) [The Staff of Entrepreneur Media, Kimball, Cheryl] on. Landscaping Is Worth $99 Billion Annually. Lawn care and landscaping is an enormous industry, with companies of all sizes and specialties across the nation. Landscaping Is Worth $99 Billion Annually. Lawn care and landscaping is an enormous industry, with companies of all sizes and specialties across the nation. Setting up a landscape gardening business could be an option to explore. This guide explains everything you need to know about how to start a landscaping. 1. Start the process with some general business tips. Regardless of your industry or niche, there are a few steps that all new small businesses should complete. In a virtual office, you might really think about setting up your trucks so that you can keep all of your equipment self-contained, so you're not having to load. We have put together this comprehensive guide for the first four steps that you need to take to start your business. What Are The Advantages Of A Landscaping LLC? · Liability protection · Tax benefits · Flexible management · Easy to set up. We're here to help you learn what you need to start a landscaping company. And, more importantly, how to put what you learn into action. We've put together a step-by-step guide on how to start your own landscaping business and a list of essential landscaping equipment. Gain experience · Choose a landscaping business name · Create a website · List the landscaping services you want to offer · Choose your. Here are some ways to enter the landscape business: Lawn care and chemical application, Landscape maintenance (mowing, pruning, weeding, clearing), Landscape. 1. Establish your business. You will need a good business plan to manage your finances and set yourself up legally. Start Your Own Lawn Care or Landscaping Business: Your Step-by-Step Guide to Success (StartUp Series) [The Staff of Entrepreneur Media, Kimball, Cheryl] on. What are the steps to starting a landscaping business? · 1. Understand the job · 2. Develop a seasonal strategy · 3. Set a legal structure · 4. Ensure you comply. A landscaping business is a low start up cost business that can provide a quick turnaround. Landscaping can be great for repeated sales. How to Start a Landscaping Business: RIGHT NOW With NO Startup Money [Kalfas, Keith] on lipetskart.ru *FREE* shipping on qualifying offers. How to Start a. If you are thinking of starting up a landscaping business, extensive knowledge, skills and experience in the gardening and landscaping industry are essential. Decide how your business will operate. Before you start your business, you need to decide what services you'll offer and how you'll work. · Consider critical.

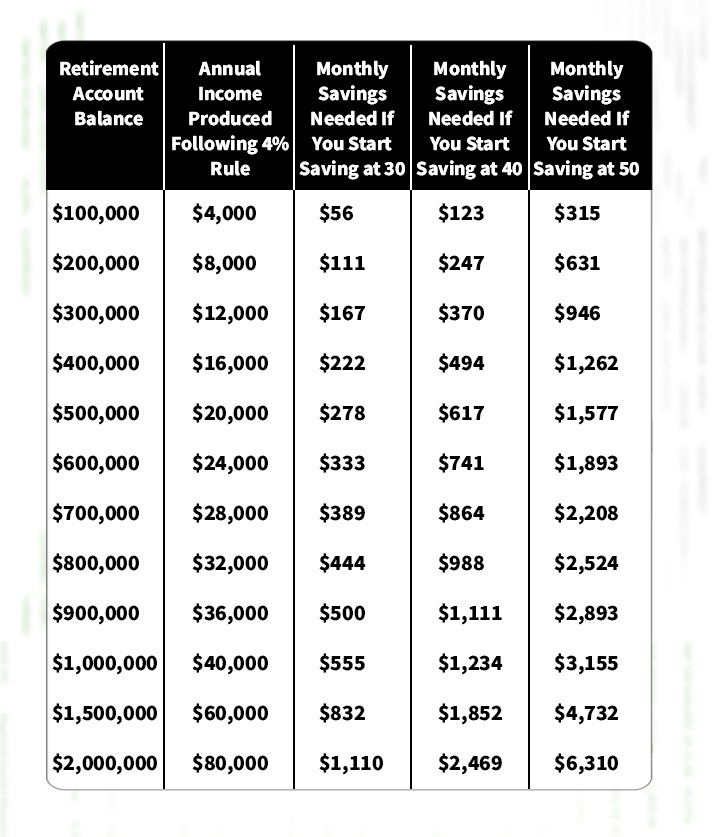

How Much Should You Save For Retirement By Age

The consensus is that by the time you retire, you should have saved at least 80% of your salary for each year of your retirement. Most experts recommend having months worth of income set aside as an emergency fund to make sure you are covered in case of a sudden loss of income. But. Someone between the ages of 31 and 35 should have times their current salary saved for retirement. Someone between the ages of 36 and 40 should have ▫ The average American spends roughly 20 years in retirement. Putting money away for retirement is a habit we can all live with. Remember Saving Matters! You should be saving % of your gross income toward retirement. · Video: Average Net Worth By Age in ! · Video: Is Saving 15% for Retirement Like Dave. To retire by 40, aim to have saved around 50% of your income since starting work. “That's going to take some real discipline,” said Michael Gilmore, a former. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. The average (k) balance by age · Average (k) balance for 20s – $82,; median – $32, · Average (k) balance for 30s – $,; median $75, Aim to save at least 15% of your pre-tax income 1 each year, which includes any employer match. That's assuming you save for retirement from age 25 to age The consensus is that by the time you retire, you should have saved at least 80% of your salary for each year of your retirement. Most experts recommend having months worth of income set aside as an emergency fund to make sure you are covered in case of a sudden loss of income. But. Someone between the ages of 31 and 35 should have times their current salary saved for retirement. Someone between the ages of 36 and 40 should have ▫ The average American spends roughly 20 years in retirement. Putting money away for retirement is a habit we can all live with. Remember Saving Matters! You should be saving % of your gross income toward retirement. · Video: Average Net Worth By Age in ! · Video: Is Saving 15% for Retirement Like Dave. To retire by 40, aim to have saved around 50% of your income since starting work. “That's going to take some real discipline,” said Michael Gilmore, a former. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. The average (k) balance by age · Average (k) balance for 20s – $82,; median – $32, · Average (k) balance for 30s – $,; median $75, Aim to save at least 15% of your pre-tax income 1 each year, which includes any employer match. That's assuming you save for retirement from age 25 to age

To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. How much should you have saved for retirement by your 30s? A good rule of thumb for somethings expecting to retire around age 65 is to have the. Experts recommend that you save the equivalent of your annual salary by age Then, they suggest saving three times your annual salary by 6 times your annual salary. This makes sense if you do not have a pension but what about those who do have pensions? How much should you save on top of. By age 30, you should have one time your annual salary saved. For example, if you're earning $50,, you should have $50, banked for retirement. By age One common approach is to aim to replace 70 to 80% of your annual pre-retirement income, with an assumption that you will earn at least 2% cost-of-living raises. Alan is 53 years old and has an income of $, Because Alan is between ages in the table, he could average the multiplier ranges for age 50 (5–7x) and age. The rule of thumb you'll hear from financial planners is that you should have an amount of money equal to your retirement saved by age Did you know? $1,, saved by age 65 might only provide $37, annually through age But the real. The rule of thumb is to religiously save and invest 15% of your gross income if you want to retire at around If you want to retire sooner. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. To estimate how much you'll save by retirement age ("What you'll have"), start with your current age and how much you've saved so far. Add your income and. You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If you save 5% of. But they also have their eye on the prize, retirement, and that means more aggressive saving. When considering average savings by age 50, data shows you should. While an exact percentage will vary based on your individual goals and timeline, a general rule of thumb is to save 10–15% of your pre-tax salary each year for. To fund an “above average” retirement lifestyle—where you spend 55% of your preretirement income—Fidelity recommends having 12 times your income saved at age Some financial planners suggest you put 5-to% of your income toward retirement each year, depending on your age. But how much should you be stashing into retirement accounts? The Center for Retirement Research at Boston College recommends putting away 15% of your annual. How much should you have saved for retirement by your 30s? A good rule of thumb for somethings expecting to retire around age 65 is to have the. Key Facts on Retirement Savings · As of , the median household retirement savings for Americans under age 35 is $18, · As of , the median household.

How To Get A Lower Interest Rate On Home Loan

Mortgage rates remained under 7% this week, averaging % for a year loan, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. Pretty simple, ask your bank for a lower rate. If there are any banks, credit unions etc out there offering rates lower than the one you are on. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing. 1. Improve your Credit score · 2. Choose the right loan tenure · 3. Opt for a Floating Interest Rate · 4. Negotiate with your lender · 5. Make a higher down payment. How to reduce your mortgage interest rate and fees · Step 1: Negotiate a lower interest rate · Step 2: Commit to extra payments · Step 3: Consider an offset. So while you may be able to finance a home purchase with a down payment as low as 10%, 3% or even 0%, consider putting more money down to lower your rate. 1. Bi-weekly mortgage payments · 2. Extra mortgage payments · 3. Drop Private Mortgage Insurance (PMI) · 4. Recast your mortgage · 5. Streamline refinance. The best ways to reduce your home loan interest rate · 1. Go for a shorter loan period. Your loan repayment period is one of the primary factors responsible for. Refinancing your mortgage is often a great financial move if you can qualify for a rate lower than your current rate and shorten your loan term. However, make. Mortgage rates remained under 7% this week, averaging % for a year loan, according to Bankrate's lender survey. Thirty-year mortgage rates haven't been. Pretty simple, ask your bank for a lower rate. If there are any banks, credit unions etc out there offering rates lower than the one you are on. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing. 1. Improve your Credit score · 2. Choose the right loan tenure · 3. Opt for a Floating Interest Rate · 4. Negotiate with your lender · 5. Make a higher down payment. How to reduce your mortgage interest rate and fees · Step 1: Negotiate a lower interest rate · Step 2: Commit to extra payments · Step 3: Consider an offset. So while you may be able to finance a home purchase with a down payment as low as 10%, 3% or even 0%, consider putting more money down to lower your rate. 1. Bi-weekly mortgage payments · 2. Extra mortgage payments · 3. Drop Private Mortgage Insurance (PMI) · 4. Recast your mortgage · 5. Streamline refinance. The best ways to reduce your home loan interest rate · 1. Go for a shorter loan period. Your loan repayment period is one of the primary factors responsible for. Refinancing your mortgage is often a great financial move if you can qualify for a rate lower than your current rate and shorten your loan term. However, make.

Will Refinancing Your Mortgage Get You a Lower Rate? If mortgage rates have fallen since you took out your mortgage, or if your credit score has improved. How to Get a Lower Interest Rate on Your Home Loan · How to Get a Lower Interest Rate on Your FHA Mortgage: Credit Scores · Get a Better Interest Rate on Your. Here are some of the program's features: • Competitive fixed interest rate loans Applicants must have a steady job, good credit history, sufficient. Getting a low mortgage rate can be possible if you shop around for quotes, improve your financial standing, and ask for a rate match. Refinance your mortgage with our low refinance rates — and potentially lower your monthly mortgage payment lower interest rate for an initial portion of the. A Department of Veterans Affairs (VA) Interest Rate Reduction Refinance Loan (IRRRL) can be used to refinance an existing VA loan to lower the interest rate. 1. Choose a Few Mortgage Lenders to Shop With · 2. Compare Rates on Different Types of Mortgages · 3. Consider Less-Common Rates and Terms · 4. Get Loan Estimates. You'll reduce the chance the rate might increase before you close. Work with your loan officer to determine how long you should lock in your rate, and make sure. Get quotes from at least three lenders. Local lenders and credit unions tend to offer lower mortgage rates than big banks. You can also shop at online lenders. You can buy down your interest rate by up to percent to reduce your interest costs and get a lower payment. Before you choose to complete a rate buydown. Find a private lender. Maybe a family member will give you a low interest loan? Or you can find a new home builder with excess inventory that. Let us help find the home loan that's right for you. Our home loans — and low home loan rates — are designed to meet your specific home financing needs. A variable rate mortgage is better if you expect interest rates to decrease during your term. If rates drop, you'll pay off your mortgage faster since more of. Down payment: Generally, a higher percentage down payment equals a lower interest rate. The more money you put down, the more stake you have in the property. Negotiating mortgage rates is something all homebuyers will do. Here are some of the most common factors you can control to get a lower interest rate. 1. Research Mortgage Interest Rates · 2. Decrease Your Debt-to-Income Ratio · 3. Improve Your Credit Score · 4. Increase Your Income Stability · 5. Gather Your. How To Get the Best Mortgage Rate Today · Take stock of your financial situation. Before you fall in love with your dream home, you better make sure you can. If you've ever wanted to upgrade to a larger home or a more expensive neighborhood, low interest rates can make it easier. With a fixed rate loan, you can. How do lenders calculate mortgage interest rates? · 1. The Bank of Canada's interest rate · 2. The prime rate · 3. Credit score · 4. Down payment (loan-to-value. Get the lowest home mortgage rate to buy a home. Apply for a mortgage online to see why Lower is the best mortgage lender. + 5-Star Reviews.

Att Stock Price Today Per Share

Forward P/E 1 Yr. Earnings Per Share(EPS). $ Annualized Dividend. $ Ex. In the current month, T has received 16 Buy Ratings, 7 Hold Ratings, and 0 Sell Ratings. T average Analyst price target in the past 3 months is $ AT&T Inc T:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High The Dividend Yield % of AT&T Inc(T) is % (As of Today), Highest Dividend Payout Ratio of AT&T Inc(T) was The lowest was And the median was AT&T Inc ; Previous Close: ; Open: ; Volume: 20,, ; 3 Month Average Trading Volume: ; Shares Out (Mil): 7, Discover historical prices for T stock on Yahoo Finance. View daily, weekly or monthly format back to when AT&T Inc. stock was issued ^IXIC NASDAQ Composite. 16 minutes ago. Per-Share Earnings, Actuals and Estimates ; Actual Actual Actual ; Q, Q4, Q 21 minutes ago. Forward P/E 1 Yr. Earnings Per Share(EPS). $ Annualized Dividend. $ Ex. In the current month, T has received 16 Buy Ratings, 7 Hold Ratings, and 0 Sell Ratings. T average Analyst price target in the past 3 months is $ AT&T Inc T:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High The Dividend Yield % of AT&T Inc(T) is % (As of Today), Highest Dividend Payout Ratio of AT&T Inc(T) was The lowest was And the median was AT&T Inc ; Previous Close: ; Open: ; Volume: 20,, ; 3 Month Average Trading Volume: ; Shares Out (Mil): 7, Discover historical prices for T stock on Yahoo Finance. View daily, weekly or monthly format back to when AT&T Inc. stock was issued ^IXIC NASDAQ Composite. 16 minutes ago. Per-Share Earnings, Actuals and Estimates ; Actual Actual Actual ; Q, Q4, Q 21 minutes ago.

ISIN. USR ; Shares in Issue. ; Best bid. $ ; Best offer. $ ; Day volume. 1,

View the T premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the AT&T Inc real time stock. AT&T stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Price History & Performance ; Current Share Price, US$ ; 52 Week High, US$ ; 52 Week Low, US$ ; Beta, Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding B; Public Float B; Beta The Dividend Yield % of AT&T Inc(T) is % (As of Today), Highest Dividend Payout Ratio of AT&T Inc(T) was The lowest was And the median was Key terms. Total revenue; Net income; Earnings per share. Net profit margin; Free cash flow; Debt-to-equity ratio. Ad Feedback. T Forecasts. Facts. analyst. The 52 analysts offering price forecasts for AT&T have a median target of , with a high estimate of and a low estimate of Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: Historical daily share price chart and data for AT&T since adjusted for splits and dividends. The latest closing stock price for AT&T as of August 30, Find the latest AT&T Inc. (T) stock quote, history, news and other vital information to help you with your stock trading and investing. Key Data Points. Current Price. The most recent price per share for this stock. $ Daily Change. The percentage change for this company's share price today. AT&T Inc. ; Market Value, $B ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. About AT&T (T) ; Avg. daily volume. M ; EBITDA (TTM). $B ; Open. $ ; Price / earnings ratio. x ; Today's range. $ - $ Select share(s). AT&T Corp. Share price lookup. Share Price Download. Select date. Show data. Closing prices. Download this chart as an Excel file Download this. Historical Stock Information, Quote, Common Dividends, Preferred Dividends, Quote, Stock Splits, Other Corporate Actions. AT&T Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time T stock price International stock quotes are delayed as per. trades and holding each position for 2 Years would result in % of your transactions generating a profit, with an average return of +% per trade. The current price of T is USD — it has increased by % in the past 24 hours. Watch AT&T Inc. stock price performance more closely on the chart. Latest After-Hours Trades -> ; After Hours Time (ET). After Hours Price. After Hours Share Volume ; $ 40 ; $ 50 ; $

Home Equity Line Of Credit How Much Can You Borrow

Depending on the amount available in your HELOC, you can borrow up to 65% of the determined value of your property. The total value of your HELOC and tied loans. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. If you. Through Bank of America, you can generally borrow up to 85% of the value of your home minus the amount you still owe. For example, say your home's appraised. The maximum combined (existing mortgage loan balances plus Home Equity Credit Line limit) loan-to-value ratio (“LTV”) is 80% of market value if total liens do. A home equity line of credit (HELOC) allows you to tap into your home's equity with a reusable line of credit you can access whenever you need the money, such. A maximum of 65% of the market value or purchase price of your home as a 'stand alone' HELOC; Refinance or re-qualification may be required. Of course, you'll. To find out how much you can borrow, multiply your home's appraisal value by and then subtract the remaining balance on your mortgage from the total. Using. Additional HELOC Benefits ; Enjoy financial flexibility. · Rates may often be lower than other forms of borrowing like credit cards or personal loans ; Lock in a. Starting at $5,, this ongoing line of credit lets you borrow up to 65% of your home's value 1,2. And as long as you have available credit and make your. Depending on the amount available in your HELOC, you can borrow up to 65% of the determined value of your property. The total value of your HELOC and tied loans. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. If you. Through Bank of America, you can generally borrow up to 85% of the value of your home minus the amount you still owe. For example, say your home's appraised. The maximum combined (existing mortgage loan balances plus Home Equity Credit Line limit) loan-to-value ratio (“LTV”) is 80% of market value if total liens do. A home equity line of credit (HELOC) allows you to tap into your home's equity with a reusable line of credit you can access whenever you need the money, such. A maximum of 65% of the market value or purchase price of your home as a 'stand alone' HELOC; Refinance or re-qualification may be required. Of course, you'll. To find out how much you can borrow, multiply your home's appraisal value by and then subtract the remaining balance on your mortgage from the total. Using. Additional HELOC Benefits ; Enjoy financial flexibility. · Rates may often be lower than other forms of borrowing like credit cards or personal loans ; Lock in a. Starting at $5,, this ongoing line of credit lets you borrow up to 65% of your home's value 1,2. And as long as you have available credit and make your.

You can take out any sum up to your HELOC maximum at any time up to your loan limit. However, there are benefits to locking in the rate on larger sums. Here's. For example, a lender's 80% LTV limit for a home appraised at $, would mean a HELOC applicant could have no more than $, in total outstanding home. How a Home Equity Line of Credit Works: With a Home Equity Line of Credit, you are borrowing against the available equity in your home, and your house is used. Are a HELOC and a Home Equity Loan the same thing? The short answer is: No. If you take out a HELOC with AmeriSave, you will receive the full loan amount. Homeowners may be able to borrow up to 85% of the equity in their property with a home equity loan. A HELOC is a line of credit that uses your home as collateral. The amount you can borrow is based on the value of your home minus any mortgage(s) you may have. With Tangerine, you can borrow at a low interest rate and tap into the equity you've built in your home without breaking your mortgage and paying a penalty. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. The government has also mandated rules in terms of the maximum amount you can borrow as a second mortgage. You can borrow up to 80 percent of your home's. Use the line of credit portion to finance up to 65% of the value of the property. You can access your repaid principal. Given a 20% down payment and a line of. You can borrow up to 65% of your home's current market value minus any outstanding mortgages on your home. Money you use: Say you took out a HELOC for $25, With a TD Home Equity FlexLine, you may be able to borrow up to 80% of your home value if you opt for a Term Portion at set-up, compared to the maximum 65% in. Interest rates are typically lower than credit cards and other loans. · Fixed and Variable Rate Options are available for a balance you've taken. · The interest. You may qualify for a $49, credit line. *indicates required. Appraised value of your home:*. How much can I borrow with a home equity loan? A home equity line of credit (HELOC) is a secured loan tied to your home that allows you to access cash as you need it. You'll be able to make as many. Don't let your home just sit there — get it working for you. When you secure a line of credit to a property you own, you can borrow larger amounts at lower. With a HELOC, you have a specific amount that you can borrow from – this amount is your line of credit. In addition to choosing the amount you need to borrow . Flexible Borrowing Options. Borrow up to 95% of the equity in your home at competitive rates and terms, making it easier to qualify and save money. Are you considering a home equity line of credit (HELOC)? Uncover how much money you can expect to borrow, alternative financing options and more.

What Drives Mortgage Interest Rates

The interest rate on your loan can impact the amount of money that you pay each month and over the life of your loan, so naturally, you want to get a highly. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. This funding cost makes up most of the interest rate on your mortgage. Other factors include your lender's operating costs and how much the lender needs to. When it comes to your mortgage rate, lenders determine your interest rate by using one of these indexes as a base rate plus a margin. The margin is primarily. Each time you make a monthly payment, a portion of that payment goes to cover your principal—or the loan amount—while the rest covers your mortgage interest. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! Interest rates change due to fluctuations in the supply and demand of credit. When demand for credit is high or when supply of credit is low, interest rates. Specifically, they're tied to the prime lending rate set by the banks. Typically, the prime rate is based on the overnight lending rate set by the Bank of. The Federal Reserve has raised interest rates to fight inflation. As interest rates rise, it costs more to borrow so people buy less. Less demand lowers. The interest rate on your loan can impact the amount of money that you pay each month and over the life of your loan, so naturally, you want to get a highly. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. This funding cost makes up most of the interest rate on your mortgage. Other factors include your lender's operating costs and how much the lender needs to. When it comes to your mortgage rate, lenders determine your interest rate by using one of these indexes as a base rate plus a margin. The margin is primarily. Each time you make a monthly payment, a portion of that payment goes to cover your principal—or the loan amount—while the rest covers your mortgage interest. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! Interest rates change due to fluctuations in the supply and demand of credit. When demand for credit is high or when supply of credit is low, interest rates. Specifically, they're tied to the prime lending rate set by the banks. Typically, the prime rate is based on the overnight lending rate set by the Bank of. The Federal Reserve has raised interest rates to fight inflation. As interest rates rise, it costs more to borrow so people buy less. Less demand lowers.

With an adjustable-rate mortgage (ARM), the interest rate may change periodically during the life of the loan. You may get a lower interest rate for the initial. Rate, points and APR may be adjusted based on several factors, including, but not limited to, state of property location, loan amount, documentation type, loan. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up. A mortgage rate is the interest rate you pay on the money you borrow to buy your house. A lower mortgage rate makes homes more affordable because it costs. The Federal Reserve raises and reduces short-term interest rates in reaction to trends in the economy, which in turn causes mortgage rates to rise and fall. Interest rates are affected by many outside forces too including supply and demand, economic policies, and inflation. Read on in this blog to find out what. By focusing on factors such as your credit score, down payment, and loan term, you may be able to secure a lower interest rate and save money over the life of. Your credit score, down payment and loan term are key ingredients that help determine your mortgage rate. These may include credit scores, credit reports, factors such as your income and the length of the loan. Economic trends, such as the benchmark interest rates. A mortgage rate is the interest rate you pay on your mortgage loan. Mortgage rates change daily and are based on fluctuations in the market. Rates continue to soften due to incoming economic data that is more sedate. But despite the improving mortgage rate environment, prospective buyers remain. Economic factors can drive bond prices lower, which makes mortgage interest rates rise. The best way to find out how much house you can afford is to get a. A high down payment decreases the risk to the lender because more equity is owned in the home. Loan Type. Different mortgage types have different interest rates. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the. Mortgage rates are driven by investor demand · Investors view mortgages as similar to bonds (lower risk, more stable return) · Unpredictable consumer behavior. Your credit score is a summary of the risk you present to a lender. A higher credit score is one factor in gaining a lower interest rate because it shows you. Whether the home will be a primary or secondary residence can also affect the interest rate. Other factors that come into play are your income, credit history. The Federal Reserve Bank plays a pivotal role in determining mortgage rates. Interest rates are affected by the increase and decrease in the supply of money as. Better credit scores and/or a shorter loan term can typically lead to a lower interest rate. We also consider the current mortgage market environment. The Fed.