lipetskart.ru

Market

Options In An Ira Account

Other IRA product options ; Inherited IRA for beneficiaries. Beneficiary can open account after owner passes ; Minor IRA for kids earning income. Income-earning. If your company permits transfers to your own IRA, you can create an IRA account at a special financial institution such as Pacific Premier Trust and then move. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Assess your financial needs. What types of IRA accounts does TradeStation offer? Individual retirement accounts (IRAs) are retirement savings accounts with tax advantages. · Types of IRAs include traditional IRAs, Roth IRAs, Simplified. External retirement accounts like a k can be moved to a tastytrade IRA as well. This way, you can decide how to invest your retirement funds. You can roll. IRAs are retirement savings accounts that help you save for your retirement. Discover the different types of IRAs for your retirement savings needs. Review your options to find an Individual Retirement Account (IRA) that meets your needs. CD (Time Account) and Savings Account IRAs are available through. Low-risk investments commonly found in IRAs include CDs, Treasury bills, U.S. savings bonds, and money market funds. Higher-risk investments include mutual. Other IRA product options ; Inherited IRA for beneficiaries. Beneficiary can open account after owner passes ; Minor IRA for kids earning income. Income-earning. If your company permits transfers to your own IRA, you can create an IRA account at a special financial institution such as Pacific Premier Trust and then move. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Assess your financial needs. What types of IRA accounts does TradeStation offer? Individual retirement accounts (IRAs) are retirement savings accounts with tax advantages. · Types of IRAs include traditional IRAs, Roth IRAs, Simplified. External retirement accounts like a k can be moved to a tastytrade IRA as well. This way, you can decide how to invest your retirement funds. You can roll. IRAs are retirement savings accounts that help you save for your retirement. Discover the different types of IRAs for your retirement savings needs. Review your options to find an Individual Retirement Account (IRA) that meets your needs. CD (Time Account) and Savings Account IRAs are available through. Low-risk investments commonly found in IRAs include CDs, Treasury bills, U.S. savings bonds, and money market funds. Higher-risk investments include mutual.

IRA must have our highest IRA trading level– IRA The Works before the account has the option to enable futures trading. Please refer to the step-by-step. Fidelity Options in Roth IRA? · Covered call writing of equity options · Purchases of calls and puts (equity and index) · Writing of cash covered. With a Schwab IRA, you can choose from a wide range of investment options, including stocks, bonds, CDs, ETFs, and mutual funds. Build your own portfolio, or. Learn how to trade options within IRAs and other tax advantaged accounts, and view potential strategies to use for different account types. All IRA accounts allow for a wide range of investment opportunities. Investment choices include stocks, mutual funds and exchange-traded funds (ETFs), and. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Assess your financial needs. When you set up your IRA, you can link both your Robinhood and external bank accounts in your Retirement dashboard: Go to Account → Menu (3 bars) or Settings. Owning a Vanguard IRA means you get flexibility. We have a variety of accounts and investments to choose from. With a Principal IRA, you'll choose from a range of investment options such as mutual funds, stocks, bonds, and exchange-traded funds. An Individual Retirement Account (IRA) is a tax-advantaged account that can help you potentially build wealth for retirement more quickly when compared to a. What options strategies can you trade in an individual retirement account (IRA)?. Options trading on IRAs includes: Buy-writes; Selling covered calls; Rolling. Individual Retirement Accounts (IRAs) · Traditional IRA. Contributions typically are tax-deductible. · Roth IRA. Contributions are made with after-tax funds and. Review retirement plans, including (k) Plans, the Savings Incentive Match Plans for Employees (SIMPLE IRA Plans) and Simple Employee Pension Plans (SEP). Most accounts let you choose from a range of investments – from interest-bearing savings accounts to CDs, mutual funds, and bonds. You'll have more choices than. Generally withdraw your money, anytime, without taxes or penalties, if you are over age 59½ and have had the account five years or more. If you don't meet this. Most IRA providers offer a wide range of investment options, including individual stocks, bonds and mutual funds. If that sounds out of your league, you can. Types of IRA accounts · Traditional IRA · Roth IRA · Roth IRA for kids · Rollover IRA · Self-directed IRA · SEP IRA · SIMPLE IRA · Inherited IRA. IRAs and brokerage accounts both offer flexibility and control in terms of investment options. These include the ability to invest in stocks, bonds, mutual. Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees associated. Regions Bank offers a variety of IRAs for your individual needs. Whether you're looking for a traditional or Roth IRA, or more tailored options.

0 Percent Apr For 18 Months

Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. 0% Intro APR for 15 months on purchases and balance transfers; after that, the variable APR will be % - %, based on your creditworthiness. Balance. Save more on interest fees with our zero percent APR credit cards Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. interest jump to a penalty rate as high as %. The 0% rate is usually valid for 12 or 18 months, sometimes more. Can you pay off the transferred balance. A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying off. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Save on interest. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. Find a top zero-interest credit card in to help finance big purchases and manage debt without paying interest with Bankrate. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. 0% Intro APR for 15 months on purchases and balance transfers; after that, the variable APR will be % - %, based on your creditworthiness. Balance. Save more on interest fees with our zero percent APR credit cards Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. interest jump to a penalty rate as high as %. The 0% rate is usually valid for 12 or 18 months, sometimes more. Can you pay off the transferred balance. A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying off. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Save on interest. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. Find a top zero-interest credit card in to help finance big purchases and manage debt without paying interest with Bankrate.

0% Intro APR (18 months). Ongoing APR: % - % Variable APR. Annual Once the 0% or low interest offer ends, you'll pay a more typical ongoing. A 0% APR credit card offers no interest on purchases, balance transfers, or both for a limited time. Interest applies after the promo period. No interest if paid in full within 18 months*. on appliance and grill purchases $ and up when you use your My Best Buy® Credit Card. Interest will be. ²NO INTEREST IF PAID IN FULL WITHIN PROMOTIONAL PERIOD: 12 Months Financing on Installed Solar Purchases of $$, 18 Months Financing on Installed Solar. A 0% intro APR credit card from Wells Fargo allows you to use your low intro APR to help pay for unexpected expenses or big-ticket purchases. 0% intro APR on purchases for the first 18 months following account opening.*. 0% intro APR on balance transfers for the first 18 months following account. A 0% introductory APR offer means cardholders don't pay interest on eligible transactions for a specified period of time. Any remaining balance at the end of. With these cards, credit card issuers typically offer 0% interest for a limited period of time: 6–12 months is typical. After that introductory period ends, the. Interest Rate. 0% intro APR for 18 months from account opening on purchases and balance transfers.†. Why this is one of the best credit cards with 0% introductory APR: The Citi Rewards+® Card offers a 0% introductory annual percentage rate on balance transfers. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Capital One's low intro APR credit cards can help you save on interest. 0% intro APR for 15 months; % - % variable APR after that; Balance. When you get a credit card with a 0% APR offer, you get to pay no interest for a given number of months, typically ranging from 12 to Once the introductory. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. Our partners' introductory 0% APR credit cards promotional periods last for 6–18 months. After the intro APR period is over, the interest rate on the. No Interest for 18 Months with Equal Payments*. Minimum purchase $1, There is a promotional fee of $50 for this transaction. Apply for a CommunityAmerica credit card and pay no interest for 18 months, earn great rewards and enjoy no annual fee. Apply Today! For a limited time, get our best rate ever: 0% intro APR* on purchases and balance transfers† for 21 billing cycles. After that, the APR is variable, currently.

How Do You Amortize A Mortgage

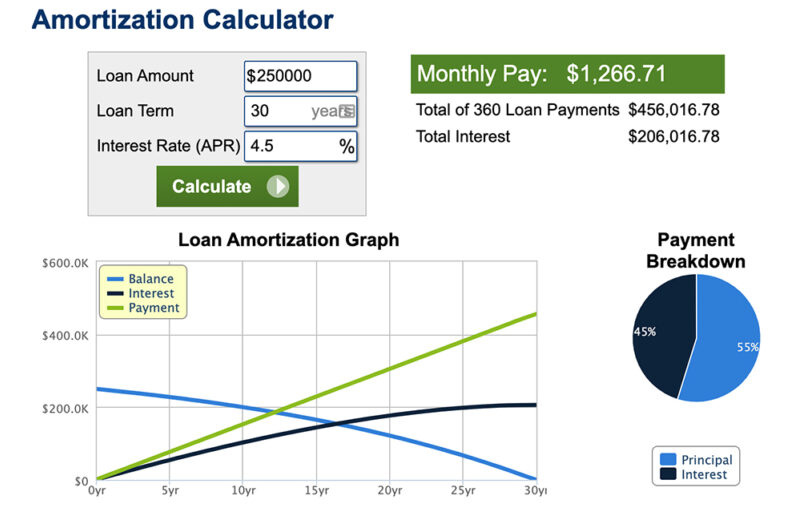

Negative amortization arises when the payment made by the borrower is less than the accrued interest and the difference is added to the loan balance. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your. Amortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest. With a fixed-rate loan, your monthly. A amortization schedule is a table or chart showing each payment on an amortizing loan, including how much of each payment is interest and the amount going. The simple formula is for calculating the monthly payment and also how to generate the amortization table, including the accrued interest and extra principal. A mortgage is a type of amortized loan, which means the debt is repaid in regular installments over a specified period of time. Mr. McGillicuddy has a mortgage of $, at 5% interest and a payment of $ If $ was paid every month for the life of the mortgage, it. Mortgage amortization ensures that you have fully paid off your mortgage interest and principal at the end of your loan's term. Negative amortization arises when the payment made by the borrower is less than the accrued interest and the difference is added to the loan balance. Bret's mortgage/loan amortization schedule calculator: calculate loan payment, payoff time, balloon, interest rate, even negative amortizations. To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your. Amortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest. With a fixed-rate loan, your monthly. A amortization schedule is a table or chart showing each payment on an amortizing loan, including how much of each payment is interest and the amount going. The simple formula is for calculating the monthly payment and also how to generate the amortization table, including the accrued interest and extra principal. A mortgage is a type of amortized loan, which means the debt is repaid in regular installments over a specified period of time. Mr. McGillicuddy has a mortgage of $, at 5% interest and a payment of $ If $ was paid every month for the life of the mortgage, it. Mortgage amortization ensures that you have fully paid off your mortgage interest and principal at the end of your loan's term.

Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments. A portion of each payment is for. Amortization is the process of paying back a loan over time using installment (regular, recurring) payments. An amortization schedule is what a lender uses to calculate what is paid first. Traditionally interest is paid first and principal paid last. Amortization is a debt repayment plan that spreads your loan across a series of fixed repayments over time. When you make payments on your loan, the. Mortgage amortization is the reduction of debt by regular payments of principal and interest over a period of time. Our free mortgage amortization schedule calculator is here to help simplify the process of choosing the best mortgage for you. It helps you understand the. For the uninitiated, amortization is a method for paying off both the principle of the mortgage loan and the interest in one fixed monthly payment. Amortization. Amortization schedules your mortgage payments and tracks what the money goes toward. Learn how amortization works in real estate for different loans. Basically a mortgage amortization is the schedule that lays out what portion of your payment goes to interest and principal each month. An amortization schedule is presented as a table that outlines key loan characteristics like payment amount, interest vs. · An “amortizing loan” is another way. When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; these are some of the most common uses of. Amortization is the process of paying off a debt with a known repayment term in regular installments over time. Mortgages, with fixed repayment terms of up to. Amortization: Months (25 Years) Periodic Payments of $ Mortgage Cost (Total Interests): $ , Amortization Schedule for Monthly. Visit RBC Royal Bank to learn how the length of your mortgage amortization period can affect how much interest you pay over the life of your mortgage. A portion of each loan payment will go toward the loan principal while the rest will cover interest charges. For how long should I have my loan amortized? Your. To calculate amortization, first multiply your principal balance by your interest rate. Next, divide that by 12 months to know your interest fee for your. An amortization calculator will show you how your balance is paid off on a monthly or yearly basis. It will also show you how much interest you'll pay over the. Wayne Passmore proposes a fixed–cost of funds index (COFI) mortgage, indexed to banks' cost of funds, which may be better than a mortgage indexed to one-year. Amortization, in lending terms, is the gradual reduction of the amount of a loan over time, through equal payments or nearly equal payments. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual.

Human Capital Measurement

Having established that measuring human capital was a worthwhile task, the CAA then considered how measures might be developed. How would success be measured. Keywords: human capital, human resource value measurement, intangible assets, knowledge sharing, psychological capital. 1. Introduction. Business leaders and. Assessing the Value of Human Capital to Stay Competitive · 1. Personal Inventories · 2. Value Added · 3. Separation Costs · 4. Total Labor Cost · 5. Average. A method for measuring ROI for people investments; 13 books, articles. Founded Saratoga Institute and consulted in 46 countries from to Learn what human capital is, how managers measure it, and how managers measure human capital's return on investment to gauge its investments. HCVA is a measure of the extent to which employees add value to the business and is a telling metric for the current global work environments. Human capital metrics (or HR metrics) are the numbers and data that human resources departments should track in order to inform their decision making. HR. human capital affects at all levels. - The growth of an individual‟ wage, firms‟ productivity, and national economy (Denison, ; Schultz, ). The index is a summary measure of the amount of human capital that a child born today can expect to acquire by age 18, given the risks of poor health and poor. Having established that measuring human capital was a worthwhile task, the CAA then considered how measures might be developed. How would success be measured. Keywords: human capital, human resource value measurement, intangible assets, knowledge sharing, psychological capital. 1. Introduction. Business leaders and. Assessing the Value of Human Capital to Stay Competitive · 1. Personal Inventories · 2. Value Added · 3. Separation Costs · 4. Total Labor Cost · 5. Average. A method for measuring ROI for people investments; 13 books, articles. Founded Saratoga Institute and consulted in 46 countries from to Learn what human capital is, how managers measure it, and how managers measure human capital's return on investment to gauge its investments. HCVA is a measure of the extent to which employees add value to the business and is a telling metric for the current global work environments. Human capital metrics (or HR metrics) are the numbers and data that human resources departments should track in order to inform their decision making. HR. human capital affects at all levels. - The growth of an individual‟ wage, firms‟ productivity, and national economy (Denison, ; Schultz, ). The index is a summary measure of the amount of human capital that a child born today can expect to acquire by age 18, given the risks of poor health and poor.

Human Capital · ESG practices call for measurement and analysis of many complex dimensions of a firm's labor supply and human resources throughout its supply. It also has to be said that the human capital measures chosen are really the eyes to the soul of an organisation's strategy. Simple measures of numbers employed. Approaches to measurement • Human capital return on investment; • Training return on investment; • Cost of absence; • costs of leavers (resignations); •. It provides a consistent method for demonstrating how strategic investments in your workforce pay off. As a metric, it helps you measure the effectiveness of. Contrary to popular belief, you can measure human capital in a scientific way. Doing so will ensure accurate and consistent reporting, thereby mitigating the. Understanding and quantifying human capital is becoming increasingly necessary for policymakers to better understand what drives economic growth and the. The concept of human capital is that the abilities, skills, and knowledge that each employee has is something that can be measured and contribute to. Human Capital ROI is a cost-based metric that reflects the return on investment in people in terms of the incremental Revenue an organization would be able to. Effective human capital II-tier measurement proffers valuable strategic information that predicts the company's future performance and provides a distinctive. 1. Measuring human capital can serve a number of purposes, e.g. to better understand what drives economic growth, to assess the long-term sustainability of. Human capital ROI (HCROI) is a strategic HR metric that reflects the financial value added by the workforce as a result of the money spent on employees. PDF | Nowadays, knowledge and technology is a key factor supporting socio-economic development. Human capital gained crucial importance for the. That's because people come with a diverse set of skills and knowledge. This relationship can be measured by how much investment goes into people's education. Human capital also contributes to growth through innovation resulting from the training of scientists, technologists and potential innovators (the knowledge-. Though HR metrics might measure the efficiency or the time and cost of HR activities, it is the human-capital metrics that measures the effectiveness of such. Human capital measurement ; M. Diane Burton · Joseph R. Rich '80 Professor, Human Resource Studies and Academic Director, Institute for Compensation Studies. We believe there are five indicators that enable companies to effectively measure and report on human capital management. We consider these to be the most. This study provides a practical insight into how different organisations devise and use human capital measures. Drawing on a series of workshops and. Human capital is a measure of the economic value of an employee's skill set. This is one of the ways to view people, or human resources, in a business. Human Capital Measurement puts a financial value on the contribution made by your employees, collectively and individually. It provides a true measure of.

Easy Home Loan Calculator

Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Your total mortgage costs include repaying the home loan with principal and interest, plus paying for monthly fees like property taxes and home insurance. As. Easy Home Calculator (House / Home Financing) Use our Calculators to Determine your Payment Plan! Mortgage Calculator · Home price · Down payment · Interest rate. Interest Rate - The percentage cost of the principal borrowed. · Loan term · Annual property taxes. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. home's purchase price and the amount of the mortgage against the property. Related Tools. Simple Loan Calculator. Find out how much a loan will cost you. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from U.S. Bank. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Your total mortgage costs include repaying the home loan with principal and interest, plus paying for monthly fees like property taxes and home insurance. As. Easy Home Calculator (House / Home Financing) Use our Calculators to Determine your Payment Plan! Mortgage Calculator · Home price · Down payment · Interest rate. Interest Rate - The percentage cost of the principal borrowed. · Loan term · Annual property taxes. Use our free mortgage calculator to easily estimate your monthly payment. See which type of mortgage is right for you and how much house you can afford. home's purchase price and the amount of the mortgage against the property. Related Tools. Simple Loan Calculator. Find out how much a loan will cost you. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from U.S. Bank.

Property Taxes Annual MIP Other Cost Home Insurance. House Price, $, Loan Amount with Upfront MIP, $, Down Payment, $17, Upfront MIP. home price, down payment, interest rate, loan term, property taxes, mortgage insurance and HOA fees. What's more, our monthly mortgage calculator with down. The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should spend no more than 28% of your pre-tax income on your. calculator. Get a detailed breakdown of monthly home loan costs for any size loan, including jumbo, refinances and cash-out loans, too. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Want to know what your loan payment will be? We've got you covered with affordable options to fit every budget. I'd like to borrow:$7, If you have a mortgage, your property tax bill may be included as part of your monthly mortgage payment. If so, the lender collects the payments and holds them. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Estimate your monthly mortgage payment with our easy-to-use mortgage calculator. VA Mortgage Calculator. Use our VA home loan calculator to estimate payments. See estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your estimated debt-to-income ratio. Your monthly payment. SmartAsset's mortgage calculator estimates your monthly mortgage payment, including your loan's principal, interest, taxes, homeowners insurance and private. Capital Bank's home loan calculator allows you to estimate your mortgage payments and easily determine how much house you can afford. Enter your monthly income or the mortgage payment you can afford, plus expenses and interest rate, to get your estimate. Home Loan EMI Calculator- Our easy housing loan EMI calculator helps you to calculate the required EMI that you need to pay for your dream home. Many personal loans are unsecured, but home and auto loans are secured, which means you provide collateral. Additionally, the bank may repossess your property. Loan details · Property taxes. The annual tax that you pay as a property owner, levied by the city, county or municipality. · Homeowners insurance. The annual fee. Use our mortgage payment calculator to see how much your monthly payment could be. View estimated house payments on year fixed and other popular loan. For those looking to secure a Texas land mortgage, our land loan calculator Secure your property loan from Capital Farm Credit. When you select a land. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property's price. Home purchase price Interest rate Loan term (years) Down payment Annual home insurance Annual property tax Monthly HOA dues Monthly mortgage insurance. Home.

Bank Account With High Balance

A Certificate of Deposit (CD) account is a low risk, high-rate savings account option with fixed rates and term lengths. The Bank uses the daily balance. The Prospera high growth savings account pays a premium interest rate every month on deposits, with two free transactions and no monthly fee. We'll waive the monthly maintenance fee each statement cycle you meet one of the following: · Maintain a minimum daily balance of $ or more in your account. Varo: Best savings account for balances below $5, Founded in , Varo is an online-only bank offering products, such as a checking account, a high-yield. Grow your savings faster with a High Interest Savings Account. Unlimited free transactions and earn % on every dollar-no minimum balance! Maintain a balance of $25, to $1,, with an increase in total relationship balances of at least $25, Frequently Asked Questions About 6-Month. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Chase Premier Savings℠. This account may let you earn better interest rates on higher balances. You'. Avoid the $12 monthly service fee with a $3, minimum daily balance each fee period. $25 minimum opening deposit. Open now. Platinum Savings. Relationship. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option with fixed rates and term lengths. The Bank uses the daily balance. The Prospera high growth savings account pays a premium interest rate every month on deposits, with two free transactions and no monthly fee. We'll waive the monthly maintenance fee each statement cycle you meet one of the following: · Maintain a minimum daily balance of $ or more in your account. Varo: Best savings account for balances below $5, Founded in , Varo is an online-only bank offering products, such as a checking account, a high-yield. Grow your savings faster with a High Interest Savings Account. Unlimited free transactions and earn % on every dollar-no minimum balance! Maintain a balance of $25, to $1,, with an increase in total relationship balances of at least $25, Frequently Asked Questions About 6-Month. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Chase Premier Savings℠. This account may let you earn better interest rates on higher balances. You'. Avoid the $12 monthly service fee with a $3, minimum daily balance each fee period. $25 minimum opening deposit. Open now. Platinum Savings. Relationship.

Maintain a balance of $25, to $1,, with an increase in total relationship balances of at least $25, Frequently Asked Questions About 6-Month. Balances are federally insured for at least $, Who uses a high-yield savings account and why? An HYSA is a good option for almost everyone with savings. Great rate with no minimum balance Grow your savings with an interest rate of % since August 01, Earn the same great rate on every dollar in your. Our Equitable High Interest Savings Account would be ideal as: · An effective cash management solution for balanced portfolios · An alternative to low-yield. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank –. Although no savings accounts pay 7% right now, there are plenty that pay high rates on your entire balance. The following accounts are great alternatives to. For example, Bank of America, Chase Bank, and Wells Fargo offer a measly APY of % on their savings accounts, whereas most of the options listed above are. Best Savings Accounts – August · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option with fixed rates and term lengths. The Bank uses the daily balance. Make your money work harder for you with an Elite Money Market Account. Enjoy earning interest on your money, overdraft protection and other great rewards. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. The difference between a high-yield checking account and a high-yield savings account is that the former is for people who maintain a high average balance. Grow your money with a high yield Savings Account. Our online savings Ally Bank Savings Accounts have a range of account balances called balance tiers. Grow your money with a high yield Savings Account. Our online savings Ally Bank Savings Accounts have a range of account balances called balance tiers. Cash in on high interest rates Get rewarded with a special relationship interest rate. Then, watch your balance grow even faster when you set up automatic. The Bread Savings High-Yield Savings Account offers a % APY with a relatively low minimum balance threshold, and it doesn't charge any monthly fees. It also. Earn daily interest on your closing balance Designed for young people under the age of 18, the Youth High Rate Savings account lets you save your own money. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. higher. • 5% for the Gold tier, 10% for the For additional terms and conditions that apply to your account (such as - fees, minimum opening balance.

How Much Can I Get Paid For Plasma

Who should donate plasma? The Red Cross urges people with type AB blood to consider a plasma donation. AB is the only universal plasma and can be given to. Fortunately, people can safely donate plasma and do it regularly. How Much Plasma Do Patients Need? According to the US Department of Health. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. All individuals are eligible to donate plasma and are typically paid cash for each donation, ranging from $50 to $ Depending on the frequency of donations. If you meet the minimum requirements to donate whole blood, you should be eligible to donate plasma*. *Women who have previously been pregnant may not be. Why donate blood plasma? Plasma increases blood volume in emergencies and much-needed plasma patients rely on every day. How often can I donate plasma? You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. How you get paid. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. You can request cash from a bank teller at any Mastercard member bank. Just remember to bring your card and ID of course. You'll be able to request a cash. Who should donate plasma? The Red Cross urges people with type AB blood to consider a plasma donation. AB is the only universal plasma and can be given to. Fortunately, people can safely donate plasma and do it regularly. How Much Plasma Do Patients Need? According to the US Department of Health. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. All individuals are eligible to donate plasma and are typically paid cash for each donation, ranging from $50 to $ Depending on the frequency of donations. If you meet the minimum requirements to donate whole blood, you should be eligible to donate plasma*. *Women who have previously been pregnant may not be. Why donate blood plasma? Plasma increases blood volume in emergencies and much-needed plasma patients rely on every day. How often can I donate plasma? You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. How you get paid. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. You can request cash from a bank teller at any Mastercard member bank. Just remember to bring your card and ID of course. You'll be able to request a cash.

Discover how easy and rewarding plasma donation can be by learning more about our eligibility requirements, process, and compensation offers. F A. Q s. f. r. o. m. y. o. u · Who can donate? · What type of medical screening is required? · Is donating plasma safe? · Does it hurt? · How long does it take? You'll typically be paid cash between $50 and $75 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. B Positive donors are financially compensated for the time they spend donating blood plasma. New (first-time) Donors can earn over $* in their first month. You can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma donation. PSG Donors is a blood and plasma donation center in. Donate your plasma for money as there is a worldwide need for plasma donors because plasma is a critical component of many life saving treatments. Where can I. your donation by becoming a plasma donor as patients of all blood types can safely receive AB plasma. Plasma donors are eligible to donate every four weeks. You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Each plasma collection facility sets its own compensation rates. Find a Donor Center. Plasma donors save lives everyday! Eligible Source Plasma donors can safely donate every three days (up to twice in any 7-day period) as long as 48 hours have passed between donations. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. How often can you donate plasma? How do you get paid? You'll receive a prepaid debit card after your first successful plasma donation. Simply walk in, donate plasma, and your card will be. During a plasma-only donation, blood is drawn from one arm and sent through a high-tech machine that collects your plasma and then safely and comfortably. How much do you get for donating plasma? Typically you can earn $$75 each time you donate plasma. Since plasma is in such high demand, many companies have. Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. How often can you donate plasma?

Open Door Real Estate Stock

The high in the last 52 weeks of Opendoor Technologies stock was According to the current price, Opendoor Technologies is % away from the week. (NASDAQ: OPEN) Opendoor Technologies's forecast annual earnings growth rate of N/A is not forecast to beat the US Real Estate Services industry's average. Opendoor Technologies Inc. provides a digital platform for residential real estate transactions. By leveraging software, data science, product design and. Opendoor Technologies Inc.(NASDAQ:OPEN): Opendoor Technologies (OPEN) stock may have been a non-starter in , but a turnaround may be imminent as the. Opendoor Technologies Inc. provides a digital platform for residential real estate transactions. By leveraging software, data science, product design and. Opendoor Technologies Inc. · AT CLOSE PM EDT 08/30/24 · USD · % · Volume33,, Opendoor Technologies, Inc. operates as an online platform for buying, selling and trading-in residential properties. Opendoor Technologies Inc. provides digital platform for residential real estates. The Company develops service model for real estate buying and selling on a. Shares of technology real estate company Opendoor (NASDAQ:OPEN) fell 14% in the pre-market session after the company reported second-quarter earnings results. The high in the last 52 weeks of Opendoor Technologies stock was According to the current price, Opendoor Technologies is % away from the week. (NASDAQ: OPEN) Opendoor Technologies's forecast annual earnings growth rate of N/A is not forecast to beat the US Real Estate Services industry's average. Opendoor Technologies Inc. provides a digital platform for residential real estate transactions. By leveraging software, data science, product design and. Opendoor Technologies Inc.(NASDAQ:OPEN): Opendoor Technologies (OPEN) stock may have been a non-starter in , but a turnaround may be imminent as the. Opendoor Technologies Inc. provides a digital platform for residential real estate transactions. By leveraging software, data science, product design and. Opendoor Technologies Inc. · AT CLOSE PM EDT 08/30/24 · USD · % · Volume33,, Opendoor Technologies, Inc. operates as an online platform for buying, selling and trading-in residential properties. Opendoor Technologies Inc. provides digital platform for residential real estates. The Company develops service model for real estate buying and selling on a. Shares of technology real estate company Opendoor (NASDAQ:OPEN) fell 14% in the pre-market session after the company reported second-quarter earnings results.

Jul AM · Real Estate Services Stocks Q1 Recap: Benchmarking CBRE (NYSE:CBRE). (StockStory) ; Jun PM · Emotional attachment may prolong. SAN FRANCISCO, Aug. 01, (GLOBE NEWSWIRE) -- Opendoor Technologies Inc. (Nasdaq: OPEN), a leading e-commerce platform for residential real estate. Opendoor Technologies Inc. operates a digital platform for residential real estate transactions in the United States. It buys and sells homes. Opendoor Technologies, Inc. engages in the operation of buying, selling, and trading of residential properties online. Opendoor Technologies Inc is a digital platform for residential real estate. This platform enables customers to buy and sell houses online. Opendoor Technologies Inc is a digital platform for residential real estate. This platform enables customers to buy and sell houses online. In trading on Monday real estate shares were relative laggards down on the day by about %. Helping Stock Market Videos from Market News Video. Company Overview. The reimagined way to buy and sell your home. Opendoor is a leading digital platform for residential real estate. In , we set out to. Opendoor Technologies Inc. provides digital platform for residential real estates. The Company develops service model for real estate buying and selling on a. Opendoor Technologies Inc is a digital platform for residential real estate. This platform enables customers to buy and sell houses online. Opendoor Technologies Inc. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Monitor the latest movements within the Opendoor Technologies Inc real time stock price chart below. What Is the Opendoor Technologies Inc Stock Price Today? Opendoor (OPEN) reported Q2 earnings per share (EPS) of -$, beating estimates of -$ by %. In the same quarter last year, Opendoor's earnings. The current price of OPEN is USD — it has decreased by −% in the past 24 hours. Watch Opendoor Technologies Inc stock price performance more closely on. In trading on Monday real estate shares were relative laggards down on the day by about %. Helping Stock Market Videos from Market News Video. In the news. Nasdaq. 2 days ago. Better Real Estate Stock to Buy: Opendoor vs. Redfin · The Motley Fool. 1 week ago. 1 Growth Stock Down 95% to Buy Right Now. Opendoor Technologies Inc · Price Momentum. OPEN is trading near the bottom of its week range and below its day simple moving average. · Price change. The. OPENNasdaq Stock Market • NLS real time price • USD. OPENDOOR TECHNOLOGIES real estate that offers buyers and sellers a digital, on-demand experience. The share price of Opendoor Technologies Inc. as of August 23, is $ / share. This is an increase of % from the prior week. The Factor Analysis. Opendoor Technologies Inc · Price Momentum. OPEN is trading near the bottom of its week range and below its day simple moving average. · Price change. The.

What Is The Best Card For Cash Back

Hear from our editors: The best cash back credit cards of September · Best for everyday spending: Chase Freedom Unlimited® · Best for rotating bonus. card or to take full advantage of their perks. Best Flat-Rate Cash Back Cards. Wells Fargo Active Cash® Card. Credit Card logo for Wells Fargo Active Cash® Card. Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Freedom Unlimited®: Best for All-around cash back · Discover it® Cash Back: Best for Quarterly. No cap on annual cashback you can earn. Fees, details and how to apply: No annual fee; Visa; Check eligibility for the Barclaycard Rewards credit card · Read. A 2% cash-back card is absolutely worth it, and we think you should have at least 1 in your wallet if you like cash-back rewards. What does 2% cash-back mean? Cash Back Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for The best card for non-category spending right now is probably the Alliant CU Visa Signature with % cash back on everything. The Citi Double Cash card tops the Forbes list of the best cash back credit cards, and with good reason. It offers an unbeatable 2% effective. Pay in Full Card with Unlimited Earn Potential Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases. Hear from our editors: The best cash back credit cards of September · Best for everyday spending: Chase Freedom Unlimited® · Best for rotating bonus. card or to take full advantage of their perks. Best Flat-Rate Cash Back Cards. Wells Fargo Active Cash® Card. Credit Card logo for Wells Fargo Active Cash® Card. Wells Fargo Active Cash® Card: Best for Flat-rate cash back · Chase Freedom Unlimited®: Best for All-around cash back · Discover it® Cash Back: Best for Quarterly. No cap on annual cashback you can earn. Fees, details and how to apply: No annual fee; Visa; Check eligibility for the Barclaycard Rewards credit card · Read. A 2% cash-back card is absolutely worth it, and we think you should have at least 1 in your wallet if you like cash-back rewards. What does 2% cash-back mean? Cash Back Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for The best card for non-category spending right now is probably the Alliant CU Visa Signature with % cash back on everything. The Citi Double Cash card tops the Forbes list of the best cash back credit cards, and with good reason. It offers an unbeatable 2% effective. Pay in Full Card with Unlimited Earn Potential Earn % cash back on every purchase of $5, or more and 2% cash back on all other business purchases.

Turn everyday purchases into unlimited cash back with a credit card rewards program. From grocery runs to gas fill-ups to dining out, whenever you use your Cash. Credit level: Excellent Good Fair Rebuilding ; Card type: Student Secured Business Personal ; Rewards: Cash Back Travel Dining $0 Annual Fee. The Chase Freedom Unlimited card excels in the world of cash-back credit cards, with great earning potential on travel, dining, and more. RBFCU offers the calculator below that will help you choose between a cash-back credit card and a low-rate credit card. Best Cash Back Credit Cards · Chase Freedom Flex®: Best Rotating Category Cash-Back Card · Citi Custom Cash® Card: Best Cash-Back Card With Changeable Bonus. With the Bank of America® Cash Rewards credit card, earn 3% cash back in the category of your choice, 2% at grocery stores, and 1% on all other purchases. With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases. Simply swipe your card and earn cash back on every purchase you make. The typical cash back rate is between 1% and 2%, but some cards can earn up to 6% in. on up to $1, in combined purchases each quarter, automatically Earn unlimited 1% cash back on all other purchases. Learn More. The Bank of America Unlimited Cash Rewards card offers both flat-rate cash back and an intro APR with no annual fee. Find out if the card is worth it. 5 min. Hear from our editors: The best cash back credit cards of September · Best for everyday spending: Chase Freedom Unlimited® · Best for rotating bonus. What's your favorite cash-back card — and why? "The Freedom Unlimited offers at least % cash-back on all purchases, but its power goes far beyond that. Mastercard® Black Card™ · Ideal for those seeking a top-of-wallet premium card with straightforward rewards and exceptional service. · Offers a flat-rate. Get cash back at a flat rate, bonus categories, tiered rewards and more. Enjoy minimal fees. Most cash back cards don't have annual fees and often have low. We've done the analysis on the best credit card rewards schemes, incl Tesco Clubcard, Nectar & BA Miles. Find the top credit cards for rewards in the UK. Bank of America Preferred Rewards® members earn 25%% more cash back on every purchase. That means you could earn % - % cash back on every purchase. Cash Back Credit Cards ; Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APR ; Citi Double Cash® Card · Low intro APRon balance transfers for 18 months · 2%. The best cash-back card for you depends on how much you typically spend, where you spend the most money, and what other perks and benefits you value. Earn 1% cash back on all other purchases. Unlimited. Cashback Match. Get an unlimited dollar-for-dollar. Best cash back credit cards of September · Best no annual fee cash back card: Wells Fargo Active Cash® Card · Best for maximizing rewards: Chase Freedom.

Pay Student Loans Or Invest

Assuming you're paying % interest rate on your student debt, paying off that debt is the highest possible risk-free investment. Provincial or bank student loans will generally have interest payable. If you have a debt with a 5% interest rate, and you have the option to pay it down or. If your loans have a relatively low interest rate (anything below 6%), it may make sense to put more of your money towards investing, rather than paying off. The INvestEd Student Loan is different than other private loans primarily because INvestEd is a different type of lender. We work with Hoosier families at our. If your loans have a relatively low interest rate (anything below 6%), it may make sense to put more of your money towards investing, rather than paying off. Paying down high-interest debt and investing excess funds can be great ways to help achieve your financial goals. Often, though, you might have to choose. Here are some tips that can help you pay off student loans while investing and saving for retirement. See event images & testimonials about the paying for postsecondary education with less student debt presentations, printed materials, and one on one help. When deciding to pay off student loans early, there are several factors to consider, like income, types of student loans, other debt and, of course, your. Assuming you're paying % interest rate on your student debt, paying off that debt is the highest possible risk-free investment. Provincial or bank student loans will generally have interest payable. If you have a debt with a 5% interest rate, and you have the option to pay it down or. If your loans have a relatively low interest rate (anything below 6%), it may make sense to put more of your money towards investing, rather than paying off. The INvestEd Student Loan is different than other private loans primarily because INvestEd is a different type of lender. We work with Hoosier families at our. If your loans have a relatively low interest rate (anything below 6%), it may make sense to put more of your money towards investing, rather than paying off. Paying down high-interest debt and investing excess funds can be great ways to help achieve your financial goals. Often, though, you might have to choose. Here are some tips that can help you pay off student loans while investing and saving for retirement. See event images & testimonials about the paying for postsecondary education with less student debt presentations, printed materials, and one on one help. When deciding to pay off student loans early, there are several factors to consider, like income, types of student loans, other debt and, of course, your.

As a general rule, if you can earn more interest on your money by investing it than your debts are costing you, then it makes sense to invest. Pay off high-interest debt before investing. If you are paying off debt, you're not alone. Most Americans have it — including mortgages, student loans, credit. Paying off student loans early can bring peace of mind, in addition to reducing the amount of interest you pay over time. On the other hand, investing works. If you had no debt would you take a loan to invest in the market? Id pay off the debt. Obv prioritize the 4%. Leave yourself $10k in savings. Just because you have student loans to pay off doesn't mean you should put investing on hold to do it—you don't have to prioritize one over the other. 5 ways to balance student loan payments and retirement savings · 1. Refresh your budget. · 2. Consider refinancing or consolidating. · 3. Ask your employer. You can typically expect to earn more money by investing than you would lose by not paying off debt. For example, investing into a stock market index fund that. “But if you're comfortable carrying debt, paying off your student loans might not be the best use of your funds. You might find that you have other more. Student loans can be considered "good debt" because they generally carry a low interest rate, the interest may be tax-deductible, and they won't be a ding on. Student loans are expensive, but the higher salaries of those with college diplomas are still enough to justify loan debt. You can start investing early even if you have student loan debt. Take advantage of a (k) match if it's available from your employer. You'll pay more in interest if you take the standard 10 years to repay your loan(s) than if you pay it off in five years. Furthermore, extending your repayment. Mathematically, it makes sense to focus on paying off high-interest debts like private student loans and credit card debt first. Federal student loans and. "If your interest rate is low (3%–4%), then you might want to consider investing extra money while you just keep paying the monthly minimum on your student. Student loans help students pay for college and may fill the financial gap by providing essential funds to cover your education expenses. It is important to. We find ourselves frequently telling prospects and clients to slow down on paying back their student loans, and save that extra money instead. “As a general rule, especially in this low-interest-rate environment, it is not a good idea to cash in investments to pay for school or pay off school debt. Investing has the potential to generate higher returns than paying off debt. This is especially true over the long term. However, there are risks when you. In general, you will be paying a higher interest rate on your debt than you will earn through investments, so paying off debt is the smarter. If you have high interest rate credit card debt or high interest rate student loan debt, for example, it makes sense to pay that off before saving or investing.